Starting in 2018, employers can now take an additional tax credit for part of the wages that are paid to employees taking qualified leaves. However, the provision is currently set to terminate at the end of 2019, which may make some employers think twice about whether this is the right time to begin offering paid leave. This article will lay out the provisions of the new credit and provide thoughts on how employers can offer this benefit to their employees. Milliman does not provide tax advice, and the commentary provided in this article should not be construed as such. Companies are encouraged to seek tax or legal counsel before pursuing any particular tax strategy.

Who is covered?

An employer is eligible for a tax credit for eligible paid family and medical leave benefits paid to an employee who has been employed by the employer for one year or more and who earned less than 60% of the "highly compensated employee" limit under 414(q)(1)(B) in the prior year. That means, for 2018, this credit will only apply to employees who made less than $72,000 in 2017. That doesn't mean that an employer should exclude its higher-paid employees from this benefit, just that the benefits paid to higher-paid employees will not be eligible for the tax credit.

What types of leaves are covered?

In order to receive this tax credit, the program must cover the same types of leaves as those covered under the Family and Medical Leave Act of 1993. These leaves may be taken for the following reasons:

- Birth of a child

- Adoption or fostering of a child

- To care for a spouse, child, or parent with a serious health condition

- The employee's own serious health condition

- A qualifying exigency arising out of the fact that a spouse, child, or parent is on (or called to be on) active duty in the armed forces

- To care for a member of the armed forces or a veteran (with service in the past five years) with a serious injury or illness who is the employee's spouse, child, parent, or next of kin

However, if the leave is provided as vacation leave, personal leave, or medical or sick leave (other than for one of the reasons above), then the leave does not qualify for the paid family and medical leave tax credit.

What amount of benefit needs to be provided?

A benefit amount between 50% and 100% of wages must be provided for at least two weeks in order for the employer to receive the tax credit. The tax credit is only available on the first 12 weeks of benefit paid in a year. Appropriate adjustments are made for part-time employees.

How to determine the amount of the credit?

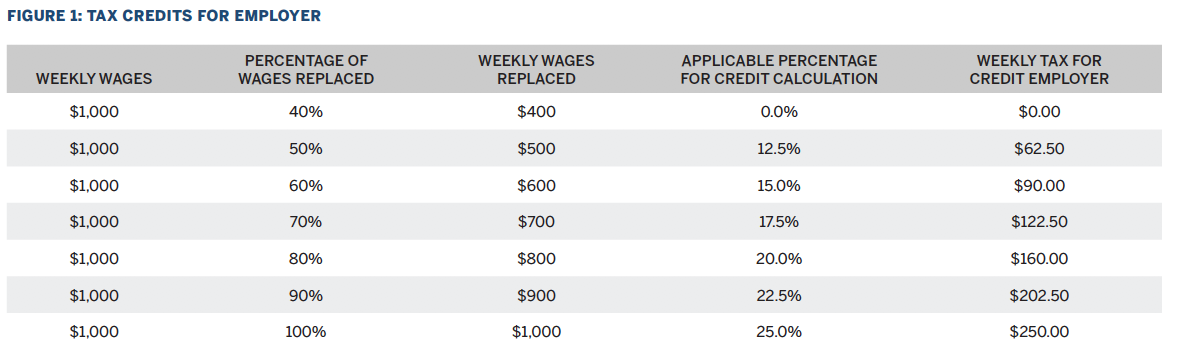

The amount of the paid family and medical leave tax credit is a sliding scale that increases from 12.5% to 25% of the amount of benefits paid to qualifying employees. The amount varies based on the percentage of the wages that are being replaced. The applicable percentage used to determine the tax credit is 12.5% increased by 0.25% for each percentage point that the rate of payment exceeds 50%. The table in Figure 1 is an example of how the tax credit works for an employee earning $1,000 per week and various options for the percentage of wages being replaced while on leave.

The tax credit increases as the benefit percentage increases, as shown in Figure 1.

Does this credit apply to employers in states that mandate paid family leave already?

This tax credit doesn't apply to state-mandated leaves. The regulation says that any leave that is paid by a state or local government or mandated by a state or local government shall not be taken into account when determining the amount of paid family and medical leave provided by the employer. Currently California, New Jersey, New York, and Rhode Island have mandated paid family and medical leave programs in place. In addition, Massachusetts, Washington, and Washington D.C. have passed leave legislations and will have mandated programs in place in the next few years.

Considerations in deciding to offer a paid family and medical leave program

If an employer decides to begin offering paid family and medical leave to its employees, it has a few decisions to make. The first decision is whether to insure the plan with an insurance company or to self-insure the benefit. If it decides to self-insure, it then will also need to decide if it wants to administer the plan on its own or if it wants to use a third party administrator (TPA).

The decision of whether to insure or not depends on the employer's risk tolerance and cash flow availability. Taking into account the employee demographics, an estimate of expected claims costs and expenses can help an employer make the right decision for itself.

Milliman has assisted numerous clients in evaluating whether or not to adopt a paid family and medical leave program for their employees. Claims costs, expenses, and other risk considerations are all important items to review before implementing a new program. The interaction of the new plan with an existing leave program is often an important consideration as well. For example, the way that employees transition from a short-term disability maternity claim to a new child family leave should be carefully thought through from both the employee and the employer perspectives. In our experience, it is not only the cost of the program but also the employee's experience, which are both important considerations.

This article first appeared in the July 2018 issue of Health and Group Benefits News and Developments.

If you would like to receive the Health & Group Benefits newsletter directly, send an email here.